A few thoughts on the (possibly controversial) subject of creating (or destroying) wealth. Wealth (and it’s cousin, “prosperity”) has been much on everyone’s mind recently, in light of the recent financial unpleasantness. I think that there’s been a lot of nonsense talked about it, and would like to present some of my understanding of the matter.

Value

What is something worth? This question can become a little philosophical, but the best concrete answer is that something is worth the most that someone will willingly pay for it. This price is obviously affected by those well-known factors “supply” and “demand”. If something is abundant, such as air, it is worth almost nothing, despite being essential to life. If something is useless, such as most forms of radioactive waste (excluding spent fuel rods) then it is also worth almost nothing, despite the great cost involved in producing it. The point is that the value of something is utterly dependent upon the circumstances in which that value is ascertained; “intrinsic value” is a meaningless concept.

Profit

To turn a profit, an enterprise must take inputs of lesser value, and turn them into outputs of greater value. This is the essence of the creation of wealth: transforming goods which could be traded for X into goods which could be sold for Y, where the difference between Y and X is a measure of the wealth created, and the net benefit to society of undertaking the enterprise.

Profit marks the enterprises which create wealth.

Destroying Wealth

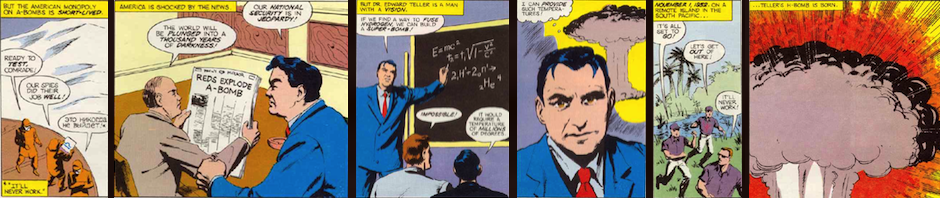

It is also possible to engage in enterprises which destroy wealth; wars are an excellent example. More insidiously, money-losing enterprises also destroy wealth; they take more-valuable inputs and transform them into less-valuable outputs. The losses of this procedure are commonly passed along to the owners of the enterprise, and may prove self-limiting, but these losses nonetheless represent the destruction of part of a society’s wealth.

True danger arises when government begins to sponsor such unprofitable enterprises; Government’s nearly unlimited access to other people’s money (i.e. U.S. gov’t spending accounts for 20% and rising of U.S. GDP) means that such losses are no longer self-limiting. If business is a wealth-creation “pump”, government money can run that pump in “reverse” indefinitely.

That’s not good, and makes us all ultimately poorer.